Introduction

From the early days of barter system to the digital form now, currency has evolved and dominated itself on the world stage. Our grain markets predominantly trade in US dollars. Officially crowned the world’s reserve currency and backed by the world’s largest gold reserves is the US dollars. A change in US dollars not only affects the global financial markets but also impacts commodity prices and trades flows. Currency exchange rates affect the bottom-line of exporters, hedgers and speculators who are involved in the agricultural industry. Which is why it is important to understand the relationship between grain markets and currencies, and to manage the risk accordingly.

Currency explained

Causes of currency fluctuations: Currency is directly impacted by a country’s economic performance. There are multiple aspects to every country’s economic performance, but the two most important aspects are economic growth and inflation. Economic growth is the measure of value of all the goods and services produced in a country during a specific period. Whereas, inflation refers to the measure at which the prices of all the goods and services are increasing in a country over a specific period of time. Both of these aspects of economy are measured in percentages, and we tend to hear about them almost every day in our lives.

According to reports released by the Reserve Bank of Australia (RBA), the monthly Consumer Price Index (CPI) indicator rose to 4.0% in May 2024. The consumer price index, which is a measure of inflation, grew by 0.4% when compared to April 2024, more than the RBA expected.

Globally, governments plan to keep a check on inflation by controlling the interest rates and maintaining food security levels. Recently, the RBA was looking to cut interest rates later this year, to bring down housing costs and to control rising interest rates by putting more money in the hands of consumers to fulfill their debt commitments. If implemented, this downward revision of interest rates could have pressured currency to decline, thereby creating a favourable international competitiveness for grain and other commodities being exported out of Australia. Now, with higher than expected CPI, the RBA may look to keep the interest rate unchanged. Alternatively, the RBA may now consider increasing interest rates later this year, to keep a check on inflation. Higher interest rates in Australia will help in maintaining stronger currency values, as money from other countries and large financial institutions look to profit and get a higher rate of return when they invest in Australia. Conversely, a lower interest rate will weaken the currency as money flows out of the country in search of better rate of return being offered. To put things into perspective, it’s like one bank offering better interest rates on your savings and fixed deposits than another bank. If the RBA decides to increase interest rates, there is a high probability of Australian currency becoming stronger and, in turn, influencing the Australian commodity prices by making them higher relative to the global market.

Currencies are globally traded, which also makes them highly susceptible to geopolitical influences. We are not short of geopolitical stories and actions that will continue to keep currency markets volatile and busy.

The year 2024 is being termed as a global election year. Recent elections in India resulted in a continuation of the old Government, which also helped in the continuation of trade policies with other countries. Now the world has eyes on the elections in US, due at end of this year. Irrespective of who wins between Trump and Biden, we are likely in for a wild ride. If the outcome of the US election is a win for the Republicans (Trump), the probable result will be a decline in US-China relations. With all these geopolitical tensions going on, the US dollar isn't the only currency that will be experiencing harsh moves in the future.

For a few important grain trading countries, like Argentina and Brazil, new reforms have already caused significant currency depreciation. Currently, this might have given some of the strength to the US dollar. Until now, this ‘higher for longer’ currency theme has given underlying support to the US dollar but, going forward, this might take a turn because of rising geopolitical issues with China, Russia and Middle East. A weaker US dollar will not only result in Australian currency getting stronger, but it will also affect the trade, by making Australian grain expensive globally.

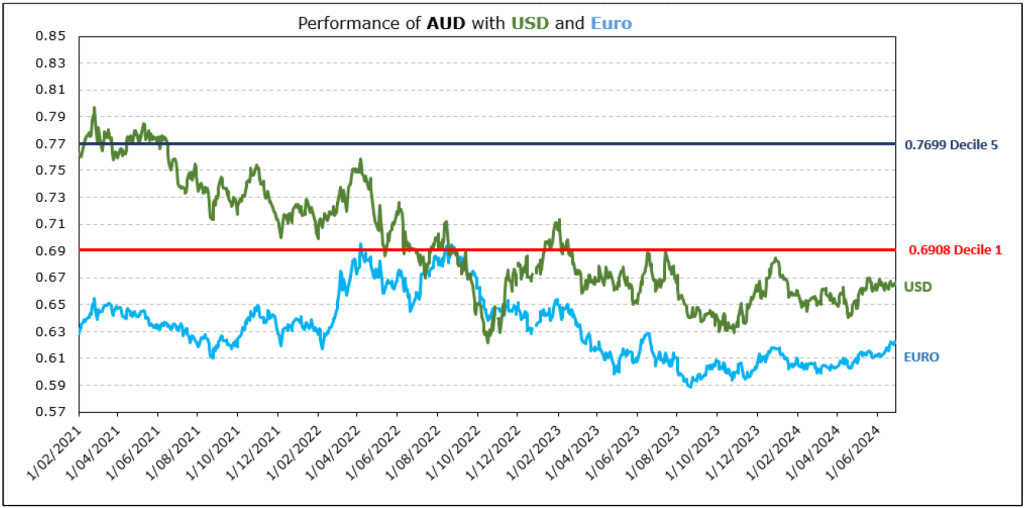

Above image shows the performance of Australian Dollar against the USD & Euro in past 3 years. The image suggests that Australian dollar has weakened against USD and Euro, post Covid-19 pandemic. Source: Pinion Advisory

Above image shows the performance of Australian Dollar against the USD & Euro in past 3 years. The image suggests that Australian dollar has weakened against USD and Euro, post Covid-19 pandemic. Source: Pinion Advisory

Conclusion

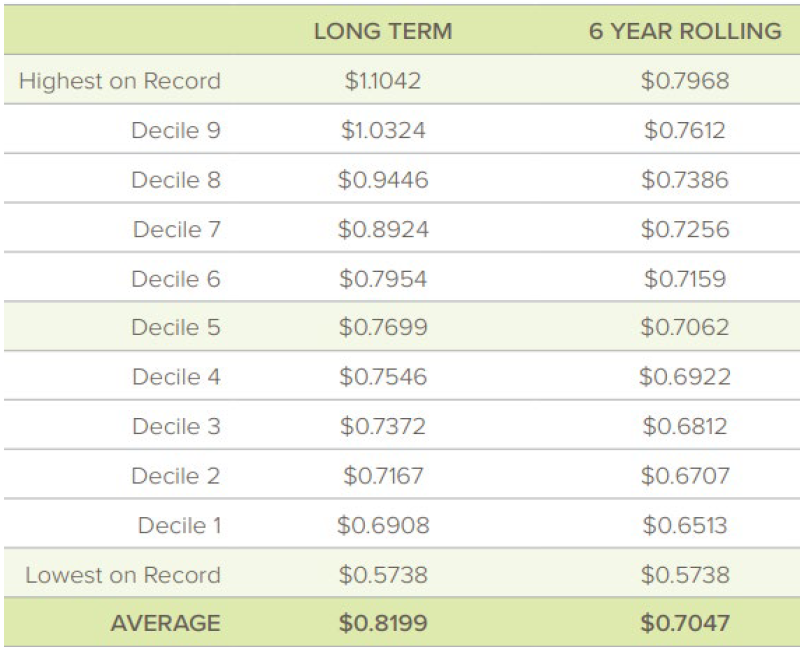

The Australian dollar is now sitting below Decile 1 against both the USD and Euro. Decile 1 is the lowest 10% of totals on a decile range. With the law of probability, the Australian currency is more likely to move up to higher deciles and values than falling further below. If this probability is realised the rise in the Australian dollar might put downward pressure on prices for grain and commodities being exported out of Australia.

Source: Pinion Advisory

Source: Pinion Advisory

The bottom line: Currency values will continue to add to volatility in the grain markets. This could have longer term impacts on the future of grain prices. The current market environment requires us to be more aware and less complacent. Having said that, the currency fluctuations do not create supply, nor do they create demand. But movements in currency do influence base price and as a result least cost supply chain. Thereby, currency plays a crucial role in global supply and demand fundamentals and has its importance in commodity pricing.

Rohit Lakhotia

Consultant, Commodity Risk Management

Pinion Advisory

Stay connected and stay supported with Pinion Grain Marketing

Whether you seek commodity risk management, grain consumer advice, or simply wish to chat, know that our doors are always open.

Contact the Pinion Grain Marketing team for more information

08 8525 3000

grain@pinionadvisory.com