Pinion Agricultural Finance

Ensuring your agriculture business has the most appropriate and cost-effective finance solution available

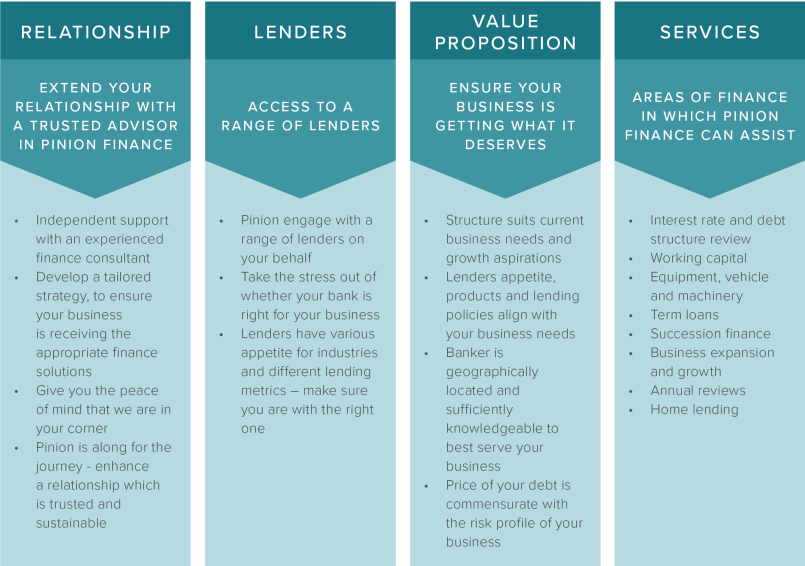

At Pinion Advisory, we get it – navigating agribusiness finances can be tricky. That's why we're here to simplify things for you. Our team understands the ins and outs of agricultural finance, and we're ready to help you seize opportunities while keeping your business stable. Our goal is to make agricultural finance less complicated so you can focus on growing your business. Trust us to be your financial partner in the field.

With Pinion Finance, you gain access to a comprehensive suite of financial solutions meticulously crafted to meet the unique demands of the agricultural sector. From optimising working capital to facilitating equipment and machinery acquisitions, our expertise extends to term loans, business expansion funding, and succession finance. We collaborate closely with you to understand your financial objectives and tailor our services to drive tangible results for your operation. Trust Pinion Finance to navigate the complexities of agricultural finance while you focus on cultivating success in your business.

Interest rate and debt structure review

Our interest rate and debt structure review service could be the key to unlocking greater efficiency and savings for your business. By thoroughly analysing your current debt structure and interest rates, we can identify opportunities for improvement and optimisation.

At Pinion Advisory, our expert consultants specialise in evaluating the intricacies of your financial setup to determine whether adjustments can be made to enhance your bottom line. Whether you're dealing with high-interest loans or outdated debt structures, our team will work closely with you to develop a customised plan tailored to your unique needs and objectives.

Our primary objective is to ensure that your business receives the service it deserves. This does not always involve breaking sound banking relationships; it just involves fine-tuning them as required to ensure they are aligned with the market.

Working capital

Understanding the complex nature of farming is what we do, including the importance of having sufficient working capital to cover cash flow timing differences through the season. Our team of experts at Pinion Advisory work with you to ensure that your financial needs are met – considering the expected volatility and unique seasonal conditions that may prevail.

A healthy working capital facility will fluctuate between debit and credit through the season. Thus, the importance of understanding the enterprise's seasonal cycle is paramount when considering the correct level of working capital available. When partnering with Pinion Advisory, you'll have access to financial solutions and a wealth of expertise in agricultural finance consultancy, ensuring that your farms working capital needs are taken care of in every season. Trust Pinion Advisory to be your steadfast companion on the journey to financial stability.

Equipment, vehicle, and machinery finance

We understand equipment, vehicles, and machinery's critical role in optimising farm efficiency and productivity. At Pinion Advisory, we offer tailored financing solutions designed to meet your specific needs, whether you're upgrading existing machinery or investing in state-of-the-art equipment. Our flexible financing options include both revolving and asset-specific facilities, allowing you to choose the structure that best aligns with your business objectives.

With fixed interest rates for the loan term and customisable repayment terms typically ranging from 3 to 5 years, our financing solutions provide you with the stability and flexibility you need to make strategic investments in your farm's future. Plus, with the equipment as collateral, you can secure the financing you need without burdening your assets.

Whether you're a small family farm or a large-scale operation, our expert team at Pinion Advisory is here to guide you every step of the way. Trust us to provide you with the financial support and expertise you need to acquire the machinery necessary to take your agricultural enterprise to new heights.

Term loans or farm loans

As your trusted partner in agricultural consultancy and financial solutions, we understand the significance of long-term assets such as land and buildings in the agricultural sector. We're here to help you secure the financing you need through our tailored term loan options.

At Pinion Advisory, we offer a range of term loan solutions designed to meet your specific requirements and financial goals. Whether you're looking for a basic loan with interest rates tied to the Reserve Bank cash rate changes or a market rate loan linked to the Bank Bill Swap Rate (BBSY), we have the expertise to guide you through the process and find the right solution for your business.

Our term loans come with customisable structures to suit your farm's unique needs, whether it's providing flexibility through redraw facilities or offering competitive interest rates to minimise your borrowing costs. With our expert guidance and personalised approach, you can access the funding you need to invest in long-term assets and unlock new opportunities for growth and prosperity.

Succession finance

Transitioning ownership within a business is a pivotal moment that requires careful planning and execution. At Pinion Advisory, we understand the complexities of succession finance and offer tailored solutions to facilitate a seamless transition for all parties involved. One common challenge in succession planning is the acquisition of assets from outgoing stakeholders, which often necessitates the use of debt financing. While vendor loan structures are prevalent, they can impose significant strain on cash flow, hindering the business's sustainability.

Our team specialises in strategic debt structuring to mitigate these pressures and optimise the succession process. By reevaluating debt arrangements and exploring alternative financing options, we can help alleviate financial burdens and expedite capital extraction for outgoing parties.

Business expansion and growth

We understand that financing growth activity with debt can be a powerful tool for driving progress and achieving your long-term goals. That's why we're here to help you navigate the complexities of debt capacity and ensure that sound financial strategies support your expansion plans.

We work closely with you to assess your business's debt capacity and develop a clear understanding of how your expansion initiatives will impact this capacity. By thoroughly analysing your financial position and growth objectives, we can tailor financing solutions that align with your needs and aspirations.

Whether you're looking to invest in new equipment, acquire additional land, or expand your operations in other ways, our team of experts guides you every step of the way. We'll help you explore financing options that optimise your debt structure, minimise risk, and maximise growth potential. With Pinion Advisory by your side, you can confidently pursue business expansion and growth, knowing you have a dedicated partner committed to your success.

Annual Reviews

Dealing with the annual bank review when borrowing over $3 million can be a daunting task. The paperwork and stress can be overwhelming. However, we are here to alleviate this burden. We see the annual review as an opportunity to evaluate your business's financial position and ensure that your current facilities align with your needs for the upcoming year.

Our team will work diligently to streamline the process, ensuring that all parties involved achieve their objectives. With our assistance, the annual review can become a constructive milestone in your business's financial planning. Banks typically reconsider a business's risk rating during this process, making it essential to ensure that your business is rated appropriately. Let us help you navigate this process and keep your business on the right track.

Home lending

Navigating the realm of home lending can often seem daunting. The various options and requirements can be overwhelming, making it challenging to understand which financing option best suits your needs. However, with the proper guidance and support, the process can be made much simpler and less stressful.

While our primary focus is on farming enterprises, we understand the importance of off-farm investments in today's financial landscape. Whether it's a city house, a holiday retreat, or an investment property, our team is highly knowledgeable in securing appropriate financing for a wide range of real estate investments. We will work closely with you, taking into account your unique financial situation, to help you select the financing option that best suits your needs. We recognise that each situation is unique, and we are committed to explaining the process clearly and addressing any concerns you may have.

Testimonial - Cumbre Group

Client name: Gavin & Heather Beever

Property location: Vite Vite North, Victoria

Property size: 336ha

Farming enterprise: Mixed

(Beef, farm consulting, farm contracting, & now cropping)

Why did Gavin and Heather come to Pinion Finance?

Gavin and Heather came to Pinion Finance to raise capital to purchase a new strategic cropping farm. Their current bank was unwilling to support the new purchase – they were seeking assistance in putting a finance request forward, which relied heavily on forward projections. They had four revenue streams, two of which were mature (beef and farm consulting) and the other two (contracting and cropping) emerging. The new contracting business had invested in a new fleet, so equipment finance commitments were significant, coupled with the need to double long-term debt and increase working capital.

How did Pinion Advisory help solve the issue?

We took the time to model the forward cash flow position, understanding the associated risks and how these risks were adequately managed. We spoke to numerous banks to ensure we positioned the deal with a lender who could resonate with the future position and was prepared to support the story, back the jockeys, and accept the risks.

How has this impacted their business:

Obtaining this cropping asset at the time they did was a significant value creator for the group. The diversification of industry and region gives the wider business options to manage their overall risk better. It also allows Will Beever (their son, who is back on the farm) the opportunity to take ownership of both the contracting and cropping enterprises in the Vite Vite North area.

Contact us

Do you have a question or want more information? Fill out the form, and our finance team will contact you.

Pinion Advisory Pty Ltd ACN 639 539 316

Australian credit licence 545355