As farmers, the ever-changing landscape of agriculture demands your attention to the soil and the financial health of your business. Recent updates from Pinion Finance highlight crucial aspects of finance that could significantly impact your farming operations.

Understanding interest rates: What Farmers need to know

The past couple of months have seen substantial change in sentiment amongst economists with regard to whether we will see the Reserve Bank of Australia (RBA) lift rates to maintain the downward trajectory of core inflation. The rhetoric on interest rates pointed towards a downward shift from as early as the second half of 2024 until the May monthly inflation printed over 4%. This pushed some economists towards a hawkish view with the potential of a few rate hikes before we see any rate cuts. The June quarterly inflation data, albeit still up from the first quarter, has eased some concerns about the need for the RBA to implement further interest rate increases.

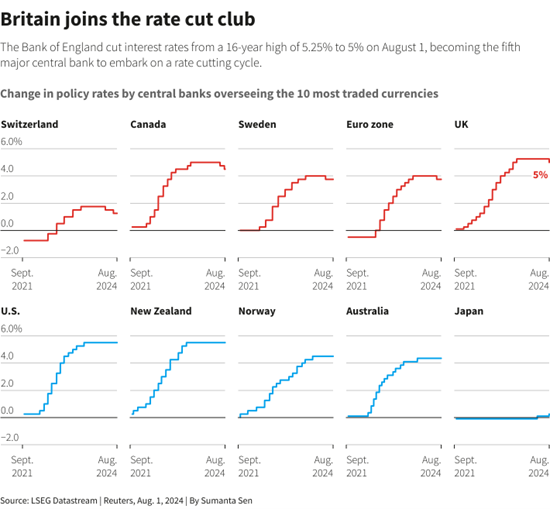

The graphs below clearly show that rate-cutting programs have commenced beyond Australia's borders. Interestingly, of the five central banks that cut rates, only Switzerland and Canada had core inflation within the target range.

Due to the RBA not having lifted rates as high as many of the other developed economies, it is believed that we would be towards the back of the queue when it comes to rate cutting. Most economists are of the view that we won’t see rate cutting until Quarter 1 2025, with the cash rate reducing to around 3.50% as opposed to the low 3’s/high 2’s forecast earlier this year.

This can obviously all change very quickly, and therefore, it’s important to have someone who ensures your interest rate risks are carefully understood and managed.

The recent fiscal budget promised to deliver $40 billion of economic stimulus, and the next couple of quarterly inflation prints will provide insights into how this impacts inflation.

Financial forecasting and ‘YIYO’

The financial year ending 30 June 2024 has proved challenging for many, particularly in the livestock sector. Pricing pressures, the late season break, and supplementary feeding have been the themes. This will impact on the year’s profitability and cash flow.

However, it remains important to maintain open communications with your financier, ensuring that the business's ‘year-in-year-out or YIYO’ position is understood. This means the through-the-cycle trading position of the business is captured within a financial forecast. From year to year, Agribusinesses will have seasonal swings, but ultimately, the debt capacity of an Agri-enterprise is derived from the through-cycle earnings and debt serviceability. Ultimately, as you want to remain conservative, you need to be realistically conservative when putting together a YIYO forecast for your business. This entails building cash flow projections up from supporting schedules (livestock/cropping or whatever the enterprise) and ensuring assumptions are well articulated and based on tangible data (e.g. for a cropping business historical yield data).

Furthermore, doing this accurately allows your business's credit rating to potentially be unaffected by challenging periods like the 2024 financial year.

Why does this matter to you

As a farmer, your success is tied to the yield of your fields and how well you manage your financial fields. Interest rate fluctuations and economic forecasts can seem distant from daily farm operations, but they directly affect your ability to invest, grow, and sustain your agricultural business.

Pinion Finance’s expansion and focus on providing top-notch services to farmers underscore the importance of having seasoned financial experts who understand the agricultural sector’s unique needs. Whether you're exploring new investments or seeking to buffer against potential financial downturns, staying informed and proactive in financial planning is essential.

Let’s talk

Remember, the doors at Pinion Finance are always open for exploratory discussions. Navigating through the financial aspects of farming requires partnership and expertise. As you continue to feed the nation, let us help you nourish your financial health, ensuring your farm survives and thrives in these fluctuating economic times.

Stay connected, stay informed, and let’s cultivate financial resilience together. For more insights and personalised advice, reach out to our team and ensure your farm’s financial footing is as strong as the ground it’s built on.

For more information on how Pinion Finance can help you

Please contact

Clint Emslie - Finance & Advisory Consultant

1300 746 466

cemslie@pinionadvisory.com